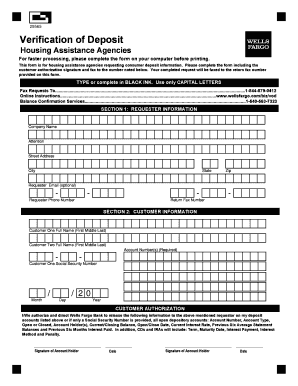

Wells Fargo Verification of Deposit Housing Assistance Agencies 2013 free printable template

Show details

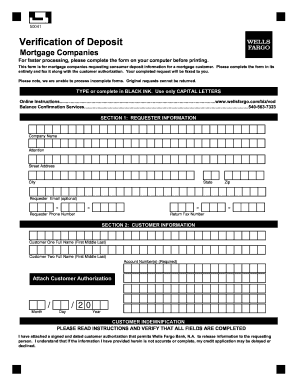

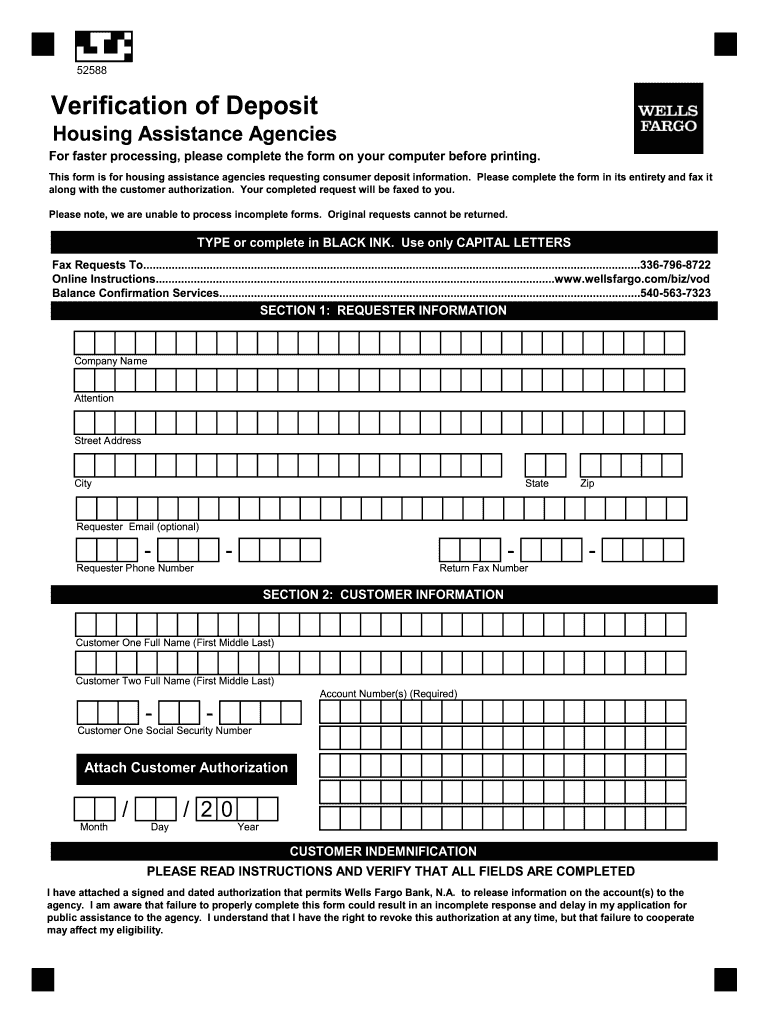

52588 Verification of Deposit For faster processing, please complete the form on your computer before printing. This form is for housing assistance agencies requesting consumer deposit information.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Wells Fargo Verification of Deposit Housing Assistance

Edit your Wells Fargo Verification of Deposit Housing Assistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Wells Fargo Verification of Deposit Housing Assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Wells Fargo Verification of Deposit Housing Assistance online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Wells Fargo Verification of Deposit Housing Assistance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Wells Fargo Verification of Deposit Housing Assistance Agencies Form Versions

Version

Form Popularity

Fillable & printabley

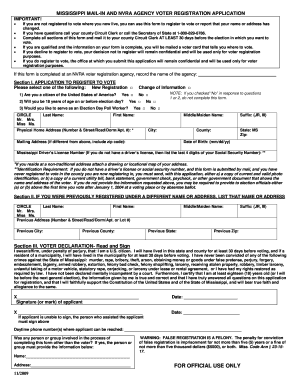

How to fill out Wells Fargo Verification of Deposit Housing Assistance

How to fill out Wells Fargo Verification of Deposit Housing Assistance Agencies

01

Obtain the Wells Fargo Verification of Deposit form from the housing assistance agency or online.

02

Fill in the account holder's information, including name and address.

03

Provide the account number for the deposit account being verified.

04

Indicate the account type (checking, savings, etc.).

05

Specify the time period for which the verification is requested.

06

Sign and date the form to authorize Wells Fargo to release the information.

07

Submit the completed form to the housing assistance agency or designated representative.

Who needs Wells Fargo Verification of Deposit Housing Assistance Agencies?

01

Individuals applying for housing assistance programs.

02

Landlords or property managers verifying tenant income.

03

Financial institutions assessing loan applications.

04

Housing assistance agencies evaluating eligibility for assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

How to get bank account verification letter from Wells Fargo?

How to download a bank verification letter Navigate to the Accounts tab. Select the checking account for which you want a bank verification letter. Select the Three Vertical Dots beside the Add Money button. Select Request Bank Verification Letter from the dropdown menu.

What is a bank account verification letter?

What Is a Bank Verification Letter? A bank verification letter is the same as a bank certification letter; a letter from a bank confirming that an individual has an account at that bank with the total value of the funds in the account.

How do I get a transaction report from Wells Fargo?

Access features quickly: Sign on to view account activity. Simply select your account to view activity. From Account Summary, click the vertical dots next to your available balance to transfer 3 money, pay bills, or view statements.

How do I get proof of payment from Wells Fargo?

Simply sign on to Wells Fargo Online and access Request Copies through the Account tab. Or you can request a paper copy from the Wells Fargo Phone BankSM or your branch. Fees may apply for paper copies.

How do I get a deposit receipt from Wells Fargo?

How do I request a copy of a deposit slip? If a deposit has already posted to your account, select View Details beside the deposit if you are already signed on. If the deposit has not yet posted, or if the deposit was made to an account you do not access online, call us at 1-800-TO-WELLS (1-800-869-3557).

What 2 forms of ID does Wells Fargo accept?

Personal Identification Social Security number. Individual Taxpayer Identification number. Green card. Foreign visa. Foreign passport number and name of issuing country. Alien identification card.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Wells Fargo Verification of Deposit Housing Assistance in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your Wells Fargo Verification of Deposit Housing Assistance along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete Wells Fargo Verification of Deposit Housing Assistance online?

pdfFiller has made it easy to fill out and sign Wells Fargo Verification of Deposit Housing Assistance. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in Wells Fargo Verification of Deposit Housing Assistance?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Wells Fargo Verification of Deposit Housing Assistance to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is Wells Fargo Verification of Deposit Housing Assistance Agencies?

Wells Fargo Verification of Deposit for Housing Assistance Agencies is a form used to verify an individual's income and financial assets as part of the application process for housing assistance programs.

Who is required to file Wells Fargo Verification of Deposit Housing Assistance Agencies?

Individuals applying for housing assistance programs that require proof of income and assets must file the Wells Fargo Verification of Deposit.

How to fill out Wells Fargo Verification of Deposit Housing Assistance Agencies?

To fill out the form, applicants should provide accurate financial details including account balances, income sources, and any other required information as specified in the form.

What is the purpose of Wells Fargo Verification of Deposit Housing Assistance Agencies?

The purpose is to provide housing assistance agencies with a reliable verification of an applicant's financial status to determine eligibility for assistance programs.

What information must be reported on Wells Fargo Verification of Deposit Housing Assistance Agencies?

The information that must be reported includes the applicant's account balances, types of accounts, income information, and any other financial assets that are relevant to the housing assistance application.

Fill out your Wells Fargo Verification of Deposit Housing Assistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Verification Of Deposit Housing Assistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.